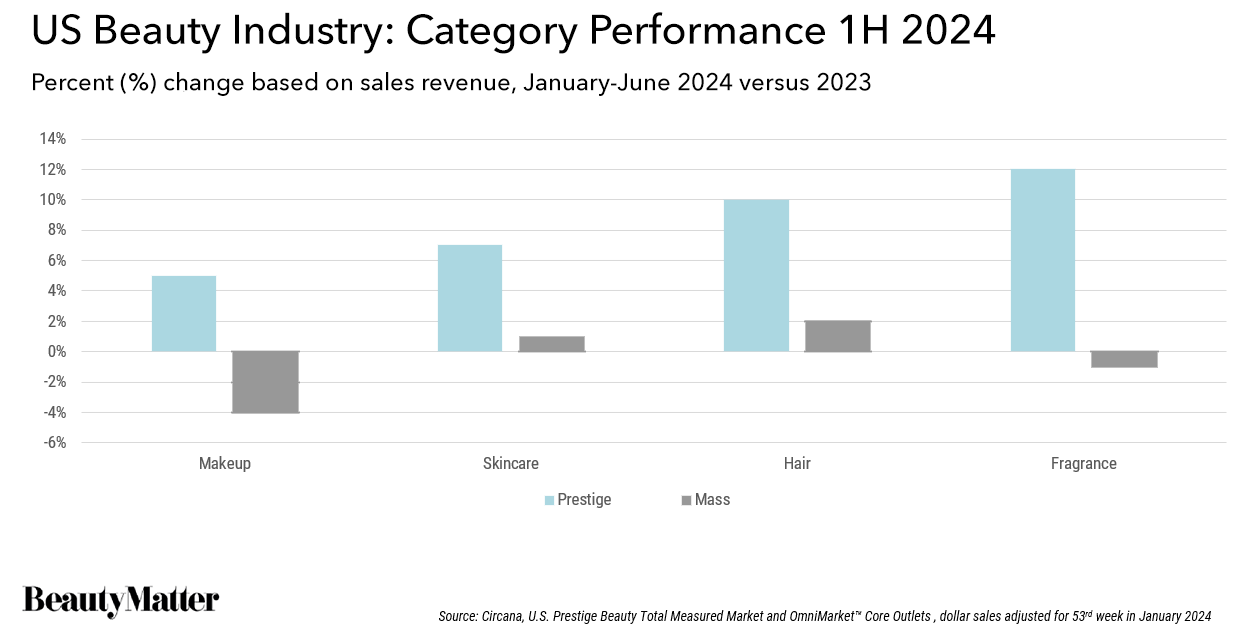

The first half of US beauty results are in, with fragrance the big winner and mass showing signs of needing a big boost. Circana reports that in the first half of 2024, the US prestige beauty market grew by 8% to $15.3 billion, while sales in the mass category held flat.

“An accelerated bifurcation is emerging in the beauty industry, highlighted by the continued strong growth in prestige in relation to the mass market,” said Larissa Jensen, Global Beauty Industry Advisor at Circana. “Within prestige, drivers of growth point to a similar pattern, indicative of a consumer who is seeking elevated value. Optimizing these opportunities will vary as consumers’ approach to beauty spending differs by demographic―from attitudes and usage, to purchase influencers and shopping preferences.”

Fragrance

Makeup

Skincare

Hair